Whether you are a first-time home buyer or a move-up buyer, housing experts in two major areas —home prices and mortgage rates — suggest buying now rather than later.

PRICES

According to a recent survey of over 100 economists, real estate experts and investment and market strategists project the average home value appreciation over the next 12 months is 4%.

MORTGAGE INTEREST RATES

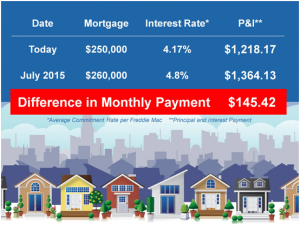

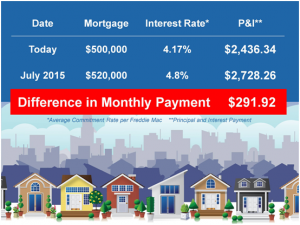

In the last Economic & Housing Market Outlook, Freddie Mac predicted that 30-year fixed mortgage rates would be 4.8% by July 2015. As of last week, the Freddie Mac rate was 4.14%.

What does this mean to you?

If you are a first-time home buyer currently looking at a home priced at $250,000, this is what it could cost you on a monthly basis if you wait to buy next year:

If you are a move-up buyer currently looking at a home priced at $500,000, this is what it could cost you on a monthly basis if you wait to buy next year:

If you are a move-up buyer currently looking at a home priced at $500,000, this is what it could cost you on a monthly basis if you wait to buy next year:  Bottom Line With both home prices and interest rates projected to increase, buying now instead of later might make sense.

Bottom Line With both home prices and interest rates projected to increase, buying now instead of later might make sense.

Talk to a Wisconsin Mortgage Corporation Loan Officer today.

Reposted for our friends at Keeping Current Matters.

Tags: buying a home, current housing market, Home Buying, living in milwaukee, Milwaukee, milwaukee lifestyle, real estate advice, real estate opportunities, shorewest, Shorewest Realtors, tips and advice, Wisconsin, wisconsin real estate

Categories: Home Buying

Sign in

Sign in

Leave a Reply